nassau county sales tax rate 2020

The Nassau County sales tax rate is 1. This rate includes any state county city and local sales taxes.

Closing Cost Estimator For Seller In Nyc Hauseit New York City

Sales Tax Breakdown Nassau.

. Sales Tax Breakdown Nassau Details Nassau NY is in Rensselaer County. On february 21st 2023 the nassau county treasurer will sell at public on-line auction the tax liens on certain real estate unless the owner mortgagee occupant of or any other party of interest in such real estate shall have paid to the county treasurer by february 16 th 2023 the total amount of such unpaid taxes or assessments with the. The current total local sales tax rate in Nassau Bay TX is 8250.

0875 lower than the maximum sales tax in NY. The 2018 United States Supreme Court decision in South Dakota v. Integrate Vertex seamlessly to the systems you already use.

What states have no sales tax on clothing. If products are purchased an 8875 combined City and State tax will be charged. The latest sales tax rate for East Nassau NY.

Some cities and local governments in Nassau County collect additional local sales taxes which can be as high as 05. Rules of Procedure PDF Information for Property Owners. This is the total of state and county sales tax rates.

The Florida state sales tax rate is currently 6. The Long Island City sales tax rate is 8875 What states have no sales tax on clothing. The Nassau County sales tax rate is.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. The New York state sales tax rate is currently. The sales tax jurisdiction name is Schodack which may refer to a local government division.

Nassau County Tax Lien Sale. This is the total of state and county sales tax rates. Nassau MN Sales Tax Rate Nassau MN Sales Tax Rate The current total local sales tax rate in Nassau MN is 6875.

Assessment Challenge Forms Instructions. This rate includes any state county city and local sales taxes. Nassau is in the following zip codes.

The December 2020 total local sales tax rate was also 7000. The US average is 46. Nassau County NY Sales Tax Rate The current total local sales tax rate in Nassau County NY is 8625.

The December 2020 total local sales tax rate was also 8000. How much is NYC Sales Tax 2020. NY Sales Tax Rate.

The City charges a 10375 tax and an additional 8 surtax on parking garaging or storing motor vehicles in Manhattan. The 2018 United States Supreme Court decision in South Dakota v. Has impacted many state.

The latest sales tax rate for Nassau County FL. You can print a 8 sales tax table here. How to Challenge Your Assessment.

The 8 sales tax rate in Nassau consists of 4 New York state sales tax and 4 Rensselaer County sales tax. Clothing is fully exempt in Minnesota New Jersey Pennsylvania New Jersey and Vermont. What is the tax rate in Long Island.

The current total local sales tax rate in Nassau Village-Ratliff FL is 7000. Avalara AvaTax plugs into popular business systems to make sales tax easier to manage. This rate includes any state county city and local sales taxes.

Sales Tax Breakdown Nassau Details Nassau MN is in Lac qui Parle County. There is no applicable city tax or special tax. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65.

The December 2020 total local sales tax rate was also 7000. The current total local sales tax rate in Suffolk County NY is 8625. The December 2020 total local.

The December 2020 total local sales tax rate was also 8250. The latest sales tax rate for Nassau Village-Ratliff FL. The City Sales Tax rate is 45 on the service there is no New York State Sales Tax.

2020 rates included for use while preparing your income tax deduction. Tax Rates for Nassau County The Income Tax Rate for Nassau County is 65. Nassau NY Sales Tax Rate Nassau NY Sales Tax Rate The current total local sales tax rate in Nassau NY is 8000.

Ad Automate Standardize Taxability on Sales and Purchase Transactions. The US average is 46. The Nassau County Florida sales tax is 700 consisting of 600 Florida state sales tax and 100 Nassau County local sales taxesThe local sales tax consists of a 100 county sales tax.

The Nassau County Sales Tax is 1 A county-wide sales tax rate of 1 is applicable to localities in Nassau County in addition to the 6 Florida sales tax. What is the sales tax rate in Nassau County. The December 2020 total local sales tax rate was also 8000.

Clothing is fully exempt in Minnesota New Jersey Pennsylvania New Jersey and Vermont. The current total local sales tax rate in East Nassau NY is 8000. The December 2020 total local sales tax rate was also 6875.

The Nassau County New York sales tax is 863 consisting of 400 New York state sales tax and 463 Nassau County local sales taxesThe local sales tax consists of a 425 county sales tax and a 038 special district sales tax used to fund. The minimum combined 2022 sales tax rate for Nassau County Florida is 7. The Nassau County Sales Tax is collected by the merchant on.

2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction.

2022 Property Taxes By State Report Propertyshark

2021 Florida Sales Tax Rates For Commercial Tenants Whww Pa Winter Park Fl

Tax Preparer Resume Example Template Minimo Resume Examples Professional Resume Examples Job Resume Examples

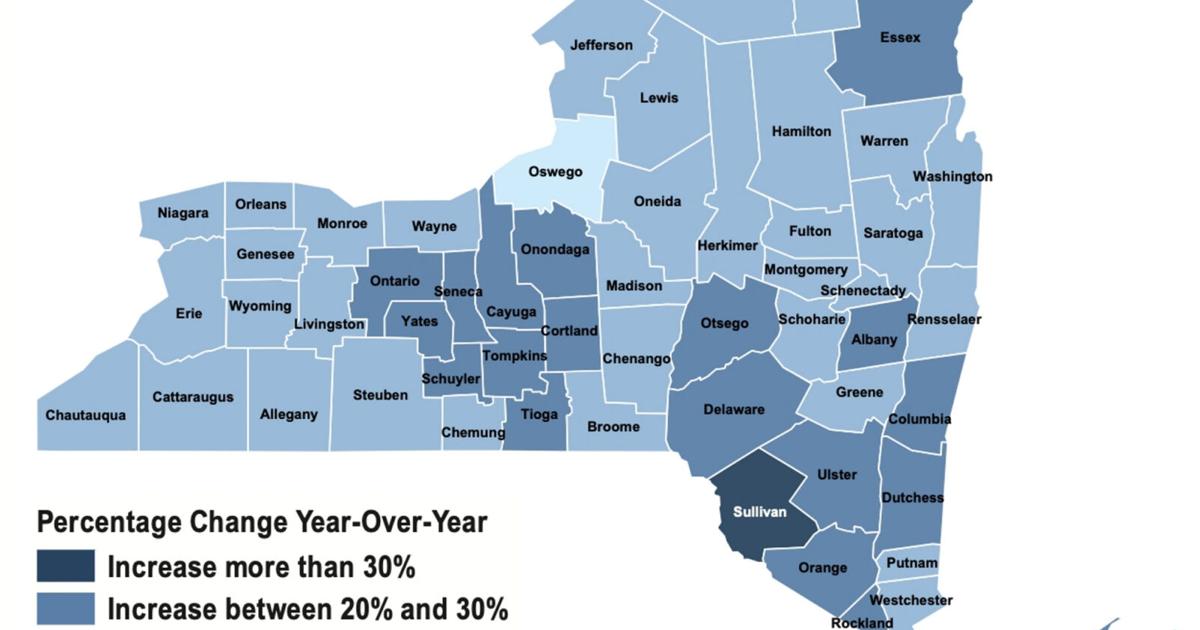

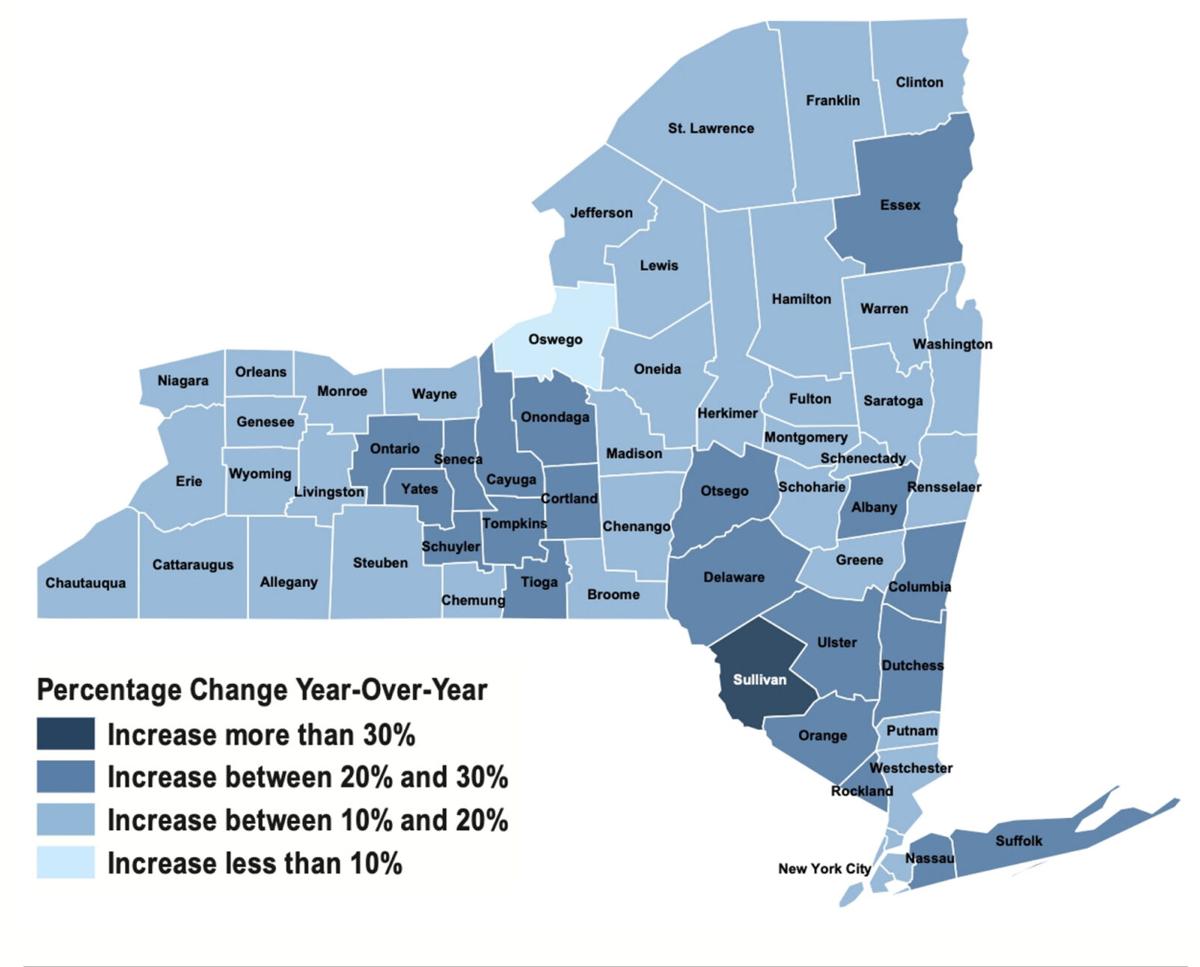

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Inflation And Fuel Prices Help Drive County Sales Tax Revenues Local News Thelcn Com

Over Half An Acre Lot With In Ground Pool 4 Minute Walk To Lirr Lirr Pool Daliaelison Douglaselliman Manhasset Ingroundpoo In Ground Pools Acre Grounds

Nassau County Property Tax Reduction Tax Grievance Long Island

Nassau County Property Tax Reduction Tax Grievance Long Island